Update: Keith and I have had a private email exchange and conversation about this. With his permission I’ve included his email in full below this post. I don’t agree with parts of it but we have come to a general agreement on a key issue. Keith will refer to himself as a “Founding Shareholder” in the future instead of a co-founder and will ask companies he is advising to update their websites and documents accordingly. I can live with this compromise and appreciate his willingness to figure this out.

“Victory has a hundred fathers and defeat is an orphan”

“Victory has a hundred fathers and defeat is an orphan”

If you’ve founded a company, or created something else in your life, you know the emotional attachment that people have to those things. It is part of who you are, part of your history. It helped define the person you are now, in large ways or small. You also understand the amount of labor and emotion people put into their creations, sometimes over years.

If someone comes and takes credit for what you’ve built, it can be painful. If they take credit for what you’ve built to enrich themselves, it can be even more painful. If they are enriching themselves in a way that hurts others, it can be too much.

What Keith Teare is doing is too much.

The backstory of TechCrunch is described here on the TechCrunch site. In June of 2005 I founded TechCrunch. At the time I was working with Keith Teare on another project called Edgeio, a company that he founded. Keith had set up a holding company for what he planned to be a number of companies. He asked me to work with him on Edgeio and possibly other companies he was to start.

I agreed and began working with him. Soon afterwards I decided to start a blog to talk about some of the amazing companies being founded in Silicon Valley and around the world. I spoke to Keith about it and asked for his help. He declined, saying it was a waste of time and suggested I focus on Edgeio. I said I was going to do it anyway, and started writing on a WordPress site that I named TechCrunch. As TechCrunch grew he quickly recognized the value of being attached to it, and started hanging out at my house and at meetups. Unfortunately though I could never get him to write anything, or help pay any bills, or do much of anything. Time went on.

After six months or so Keith claimed he owned 75% of TechCrunch because that was the equity split on Edgeio. I objected obviously, and it nearly came to litigation. Ultimately Keith knew I could just walk away from it all and TechCrunch would lose all its value, so he relented and I agreed to pay Keith 10% of any value I received in the company eventually to avoid litigation. But he never invested any time or money, or took a paycheck, and he never worked for the company in any way. He took, but he never gave.

Keith has been expanding the myth of his contributions and role at TechCrunch ever since those early days, even (repeatedly) telling people that he founded TechCrunch and hired me to write it. When he thinks I’m paying attention he just says he’s the cofounder and that we started it together. It was annoying but, whatever. Other than scamming some money out of some conferences over the years who paid him to come as the “founder of TechCrunch” not much damage was done. I pitied him, and didn’t object. I sometimes even went along with it and let him say whatever he wanted because I was too busy with my life to object. That was a mistake, as I’ve watched Keith exaggerate his contributions to TechCrunch over the years until I’m not even sure he remembers what he actually contributed – nothing of substance.

As part of that 2005 discussion with Keith, I agreed to list him as an “editor” on the site even though he never wrote anything, and also mention his holding company Archimedes Ventures. It was very important to Keith to show some connection to the company, and now Keith likes to point to this old page when disputing his relationship to TechCrunch. I find this sad. Yes I knew Keith when I started TechCrunch and yes he had every opportunity to contribute to the project, but he never did any of the hard work needed to build a company.

But more recently Keith has gotten into the cryptocurrency world, and he has been wholesale selling out to advise, from what I can tell, over a dozen companies during their token sales. Sometimes they list him as the founder of TechCrunch (as above), sometimes as the cofounder.

Nearly every week, and at an increasing rate, I’m receiving questions or comments from people asking what my connection is to some ICO I’ve never heard of. Invariably these companies list that a founder or cofounder of TechCrunch is advising. Since I am the founder of TechCrunch, people get confused and reach out to me.

This is creating significant confusion in the marketplace and these companies or projects are misleading investors, sometimes purposefully.

As we’ve all seen, the SEC is taking a long look at a lot of ICOs that happened over the last year. I’m still gathering information on all of the ones that list Keith as a founder or cofounder of TechCrunch, and my lawyer will be reaching out to all of them to ask that they correct their documents and notify token holders. I’m also asking Keith to cease stating that he founded or cofounded TechCrunch, and donate any tokens or currency he has received while saying he did so to a mutually agreeable charity.

And to Keith I’ll say this…Please stop doing this. It isn’t honest to claim that you had anything (positive) at all to do with TechCrunch. If you had helped even a tiny bit during those early days I would gladly give you credit as I do with the whole amazing team that helped build that company. But you thought it was all a stupid idea until you didn’t, and even then you just tried to take credit without ever actually helping in any material way. Please stop. You’ve done interesting things in your career. You don’t need to take the things I’ve done, claim credit and use them to prey on unwitting investors, just for a few extra dollars in advisor tokens.

As a final note, I want to add that if anyone was a “cofounder” of TechCrunch it was Heather Harde. She joined in 2007 but she was in the trenches with the team until the very end, working 20 hour days, sacrificing her personal life and giving everything she had to make the company what it was. Heather never sells herself like Keith does, but she should. Unlike Keith, she helped build that company, and gave way more value than she ever took.

Update:

Dear Mike

I read your uncrunched piece today with a mixture of sadness and shock, and like you, probably a bit of anger.

I want to respond to you privately here and if you wish you can publish it and comment.

But first I want to say that my goal in doing that is to act like a friend who cares about preserving long held relationships.

I clearly have a different understanding than you of both the course of events and also my motivations. I know that isn’t a surprise, but actually if you peel away the anger we are actually quite close in our understanding.

Why do I say that?

Firstly – I give you all of the credit for TechCrunch. As the history bellow will show, I did not build it and even suggested you should not do it. I did help you – a lot. But you have always given credit for that, just not in this piece of writing.

Secondly – I do not, and would not, seek to claim credit for your work at TechCrunch. My linkedin – which I wrote a long time ago – is clear on that point.

“I co-founded TechCrunch through my friendship and business partnership with Michael Arrington. We started edgeio and TechCrunch simultaneously whilst cooperating through Archimedes Ventures LLC. I can’t claim a lot of credit for TechCrunch … I’m the one who advised him not to do it :-). I hope I helped Mike get to the point where he wanted to do it, and was able to help him be successful.” (https://www.linkedin.com/in/kteare/)

Finally, I do not want any of my activities related to ICOs to be based on any false credit for TechCrunch.

So the only thing we actually disagree on is the history. I say I was the co-founder of TechCrunch. You say not. That may be just words. If you are saying I didn’t build TechCrunch you are 100% right. If you say I was not a founding shareholder I have to disagree. It may be a small difference.

Possibly if I say “Founding shareholder” and not “co-founder” that would settle a very hurtful episode. I certainly want to be accurate, and I certainly do not wish to harm you. I’d like to believe we can put this behind us.

That said, why do I think co-founder is the right term? What was the history as I see it?

We formed Archimedes Ventures LLC in 2005 after completing a stint consulting at VeriSign together (we had known each other for about 8 years by then). Archimedes was an LLC with a Web 2.0 goal.

At that time we were partners in an LLC. As you say in your piece we were 75-25.

At the time you were quite insistent that we could not do anything independently. In other words, you would get 25% of everything we did. I agreed happily. I loved working with you and it seemed fair.

Shortly afterwards you started techcrunch.com as a blog – you called me from LA and were pretty excited about it. I tried to talk you out of it but you were insistent and so it went ahead and I backed you despite thinking there were bigger fish to fry. As the web site from 2005 says, it became part of Archimedes Ventures LLC.

TechCrunch started small, and at the time I definitely believed it was too small to be taking all of your time. Despite that I was very supportive. I spoke with you about it often, and attended every Meetup, including the first, second, third etc, often to flip burgers for the attendees.

A little later we started edgeio. This is the first blog post about edgeio – https://techcrunch.com/2006/02/27/edgeio-launches/. And this is when we sold it – https://techcrunch.com/2007/12/06/edgeio-to-shut-down-in-the-deadpool/ where you describe it as:

“Edgeio, a company I co-founded in 2005”

Edgeio got funded and you and I were co-founders, me with 75% of the founders stock and you with 25%, reflecting our agreement in Archimedes. TechCrunch was not funded, and was not formed as a corporation at that point, but we both understood it to have the same ownership.

As TechCrunch grew, due to your efforts, you clearly felt that my ownership position was inappropriate. You made the point that you could always start something else. I don’t recall any legal threats at all. At that time we met and we agreed we should fix the ownership. I was more than willing to do so as TechCrunch was clearly mainly benefitting from your effort. The 75-25 made no sense given the situation. We eventually shook hands on 90%-10% of shares in your favor. You kept your 25% in edgeio and you were always credited with being co-founder.

That is my thoughts Mike.

If we can agree to use a term to explain my relationship to TechCrunch that does not take away the enormous credit you get for building it I would be happy to try and correct that. Maybe “founding shareholder”. I do think we should remove hurtful Tweets and put this behind us. Friendship is not the same as the unconditional love one gives a child, but it is pretty unconditional in our case. I would like to remain a friend and have you be mine too.

—

Best Regards

Keith Teare

Chat with me instantly at https://chat.center/keith

“Victory has a hundred fathers and defeat is an orphan”

“Victory has a hundred fathers and defeat is an orphan”

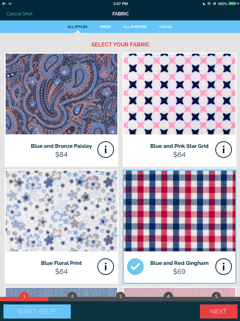

Up until now only iPad/iPhone people could use

Up until now only iPad/iPhone people could use